Yacht Crew’s guide to obtaining a mortgage

- Authors

-

-

Everyone remembers the day they received the call or email to say their mortgage application had been successfully approved! This short guide will hopefully ensure that more of you receive this good news:

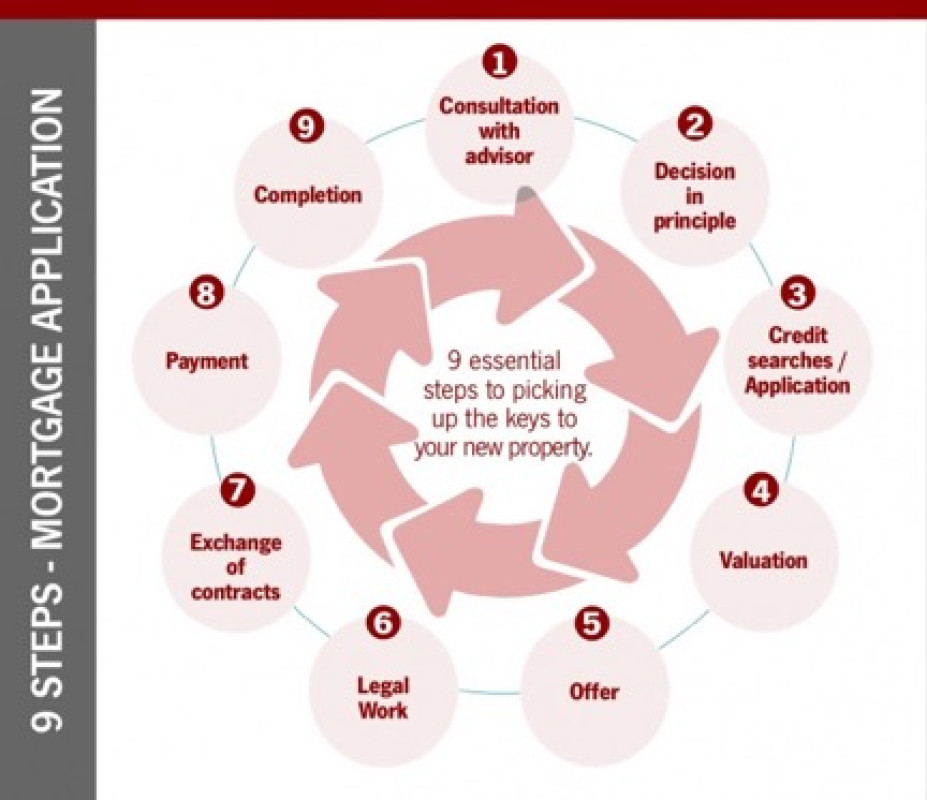

Appoint an Advisor: It is important you appoint a mortgage advisor who you can relate with. This person must understand the specific nature of your work, navigate through the pitfalls, assess your requirements and ultimately find the best mortgage for you.

Decision in Principle: This part is key to ensuring you are able to borrow money from a lender. There are too many people out there that overlook this part and jump head long into making offers on properties before they have even confirmed whether they are eligible for a mortgage in the first place.

Once a decision in principle has been accepted, you will then be issued with a key facts illustration, detailing everything you need to know about the mortgage product and repayments.

Once a key facts illustration has been issued, the mortgage application can be submitted and full searches can be completed.

Credit Searches/Applications: The lender will carry out a basic credit search on you to ensure you are a suitable candidate. A lot of lenders do a ‘hard search’ which means a footprint is left on your credit report which, in turn, can be detrimental to future applications, especially if you have too many footprints within a short space of time.

This is another reason why it is so important to seek advice from a qualified Mortgage advisor prior to beginning your application process.

Valuation: Lenders always insist on valuing the property to check it is worth the investment. It is also a worthwhile exercise for you to appoint a building surveyor at this stage who can conduct a more thorough inspection of the property.

Offer: Once the valuation has been approved, the lender will produce an offer.

Legal Work: It is important to choose the right solicitor as they play a key role at this stage ensuring that the pre-exchange of contracts runs smoothly as well as deciding on a completion date.

Exchange of Contracts: At this stage, you are legally obligated to purchase the property.

Payment: The deposit is paid and your solicitor will finalise all mortgage arrangements. This is preceded by the payment of land registry fees and stamp duty.

Completion: Funds are transferred and the purchase is complete. You are now the proud owner of a house!

The process of obtaining a mortgage can seem confusing and slightly overwhelming, but if you follow each of these steps you will find it much easier to obtain one. If you would like further advice on obtaining a mortgage please click on the link below:

Click here for Mortgage Advice

Your home may be repossessed if you do not keep up repayments on your mortgage

Any advice in this publication is not intended or written by Mortgages for Yacht Crew to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.