Green Mortgages

- Authors

-

-

Green Mortgages

According to the UK Government National Statistics, more than 15% of the total climate emissions for the UK come from residential properties. In fact, 4.7 million homes didn’t even meet the ‘Decent Homes Standard’ and a further 1.2 million households in England are considered ‘fuel poor households’, with properties so inefficient that residents struggle to meet the costs of keeping their homes warm1. To address this, some banks now offer Green Mortgages to reward customers that are buying greener homes or making their home more environmentally friendly. In theory, lower fuel bills will also equate to better affordability for the mortgage repayments, so everyone wins!

What is a Green Mortgage?

A Green Mortgage is a mortgage deal that generally offers cheaper interest rates if you buy a more energy efficient home. Existing homeowners looking to raise additional funds to make improvements to their property that make it more efficient are also eligible. Some lenders also offer cashback incentives to demonstrate their commitment to sustainable lending.

These mortgages are usually available to buy properties that meet a lender’s specified energy standard – usually an Energy Performance Certificate (EPC) of A or B, most often new build homes or those that have been modernised to become more energy efficient.

While green mortgage products have been around for some time, they are increasing in popularity and are likely to become even more so as we take more interest in sustainable living and addressing climate change. The government has an emissions target to meet by 2050, and the Climate Change Committee (CCC) wants the government to commit to making sure that all homes are rated at least C for energy efficiency by 2028. It is thought that mortgage lenders are key to ensuring the target is met by encouraging green mortgages and borrowing for environmentally friendly improvements.

Understanding EPC ratings

Energy Performance Certificates grade the energy performance of a property using the government’s Standard Assessment Procedure (SAP) out of a potential score of 100. The gradings run from A to G with A being the highest at 92 or more, while B is between 81-91. The grading demonstrates how much it will cost to heat and light a building, and what its carbon dioxide emissions might be. The grading lasts for ten years and it is now a requirement to provide a current EPC when selling a property. Most lenders make green mortgages available to borrowing on properties with high EPC scores.

Is it worth getting a green mortgage?

If you’re planning to buy a property that is already energy efficient and EPC rated A or B, then there are some mortgage deals that are cheaper than other deals available and they offer some of the lowest rates. If you are looking to improve the energy efficiency of your existing home and need to apply for additional borrowing to do so, if your bank offers green mortgages, then this could be a lower cost way to do so.

How to improve your home’s rating

The existing certificate for your property should give some recommendations on measures you could take to improve the energy efficiency of your home and, in turn, lower your fuel bills. Some of the improvements include adding loft insulation which is low cost, easy to install and pays for itself in less than five years; upgrading windows and doors to double glazing to not only improve energy efficiency, but also reduce noise; adding cavity wall or roof insulation; buying a more efficient boiler; and using a smart meter from your energy supplier.

The future of green mortgages

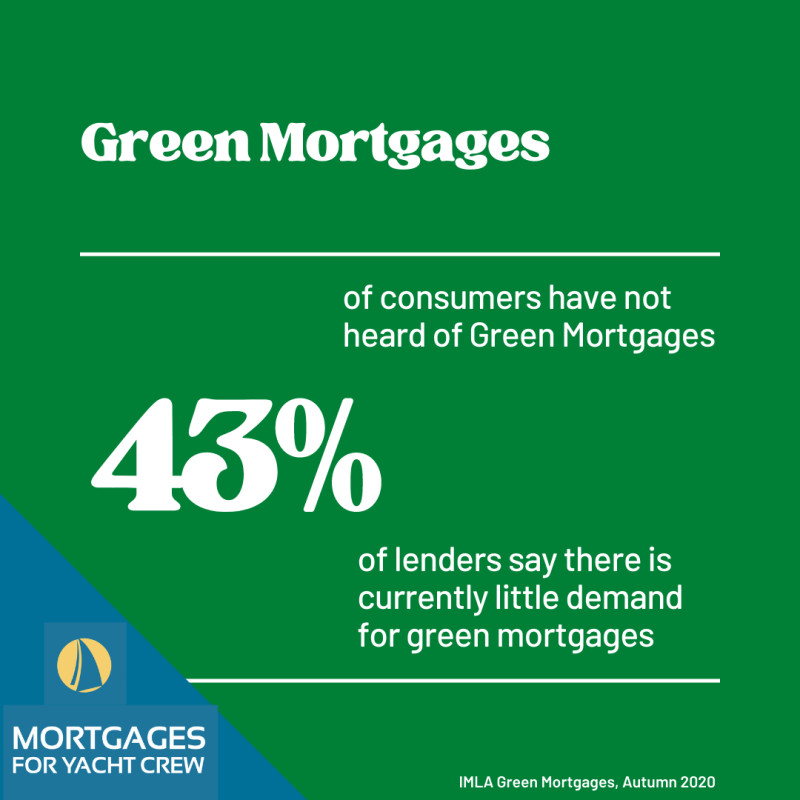

With more lenders ready to begin offering green mortgages, what is currently seen as a niche product, should soon become more mainstream, as additional buyers embrace the opportunity to play their part in saving the environment.

1 IMLA Green Mortgages, Autumn 2020

IMPORTANT: Mortgages for Yacht Crew does not provide advice in relation to savings and investments. This article is intended for discussion only and does not propose financial advice in any way, and therefore should not be construed as such. Your property may be repossessed if you do not keep up with mortgage repayments.